Budgeting for the product development process of a digital banking offering is a thorny issue for many teams. The increased time needed to roll out a feature, the lengthy research process and the lack of a concrete business case that maps out next steps can skyrocket budget consumption. And this could mean that a project could be cancelled or that others will be put on indefinite hold.

This, however, does not have to be the only way forward.  , the digital banking research platform, deeply entrenched into the biggest issues that affect the digital banking product development process can aid you get control of your budget.

, the digital banking research platform, deeply entrenched into the biggest issues that affect the digital banking product development process can aid you get control of your budget.

Optimize competitor analysis

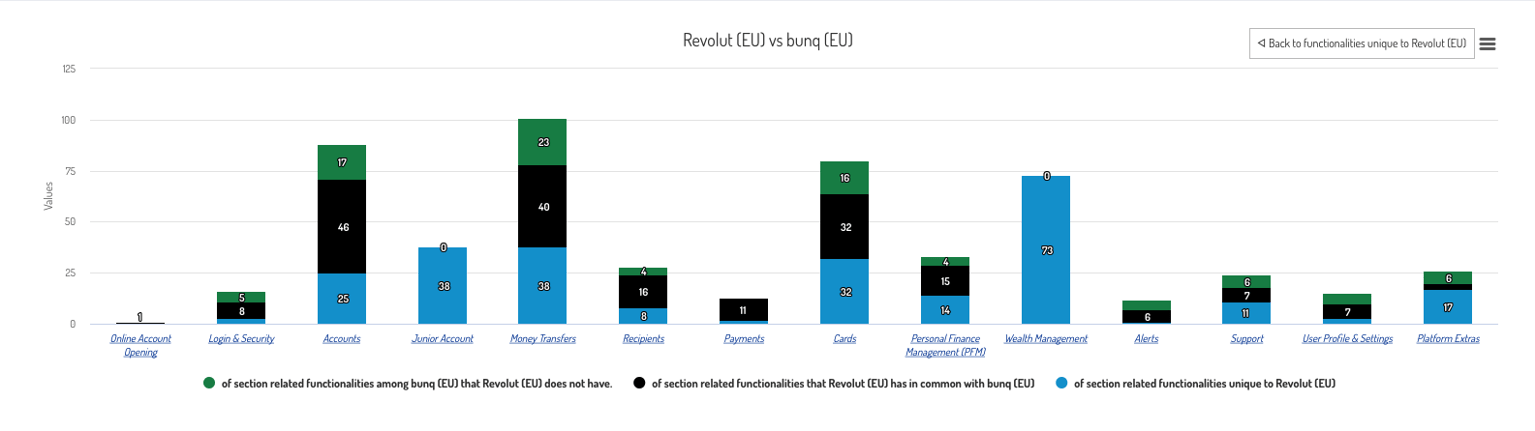

Spend less money purchasing rigid, limited to a part of the market reports that are too expensive and quickly become outdated. With  ' continually updated data sets of analyzed banks and fintechs features worldwide, log in and know which competitors offer and what in moments. Take advantage of the manpower behind the platform to enhance your analysts’ team reach, allowing them to more efficiently and cost-effectively monitor your competitors.

' continually updated data sets of analyzed banks and fintechs features worldwide, log in and know which competitors offer and what in moments. Take advantage of the manpower behind the platform to enhance your analysts’ team reach, allowing them to more efficiently and cost-effectively monitor your competitors.

With comprehensive reports completely tailored to your market you will always be in the know for new features and trends in the market. Perform gap analysis in a few clicks, discover the features missing and desperately requested in your market and introduce them first.

Cut down on your time-to-market

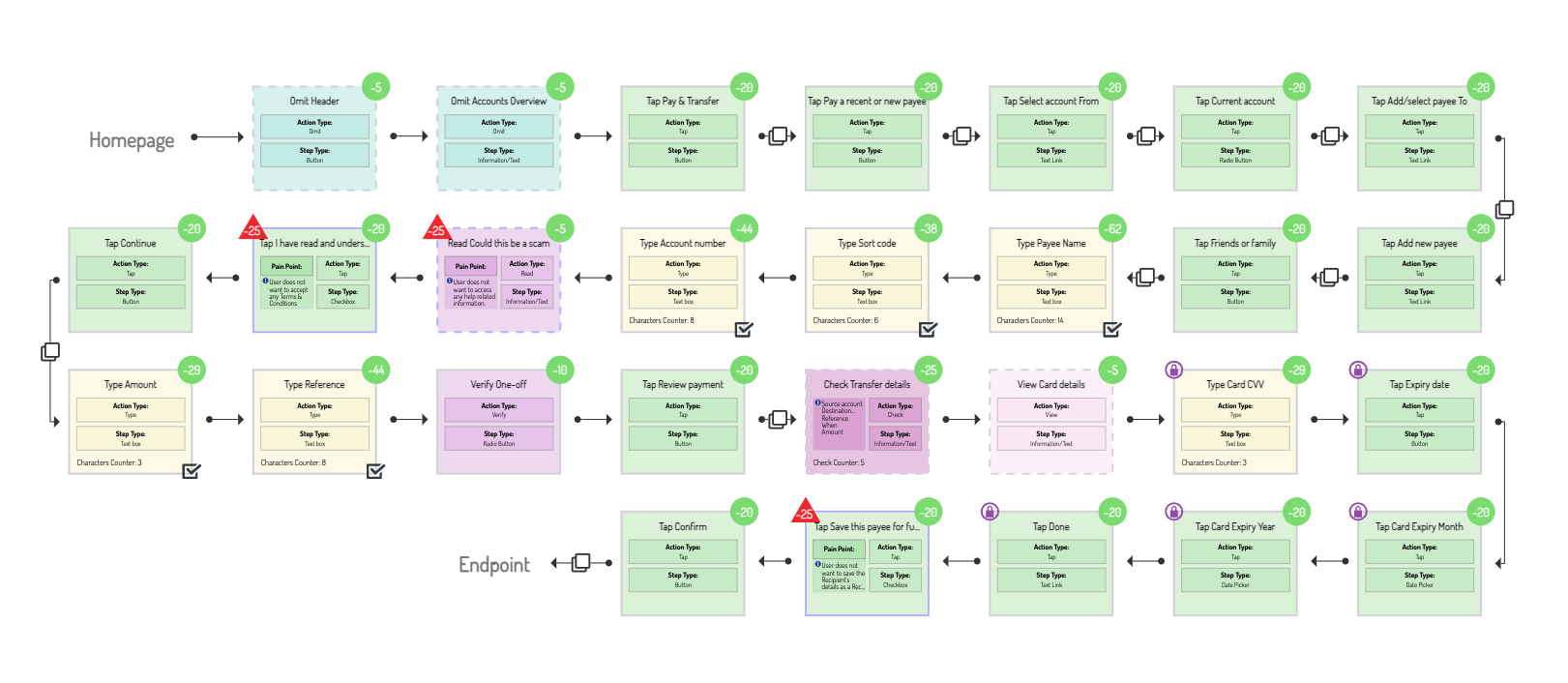

Extensive go-to-market time is the number one factor that skyrockets your budgetary needs for your digital banking product development. Clearly and effectively create a road map for your new product development in half the time by seeing how others have achieved what you are trying to build through walkthrough videos of how they offer it. No more budget overspend trying to reinvent the wheel for every single new feature.

Head behind the login screens of banks and fintechs worldwide and understand what features customers respond to best and why. Know their friction points and plan your product development accordingly, eliminating the number of re-designs required before the launch.

Innovation should not cost that much

Don’t shy away from innovation because it costs too much. Use  ' actionable data on the best features and user journeys offered around the globe to spark your team brainstorming sessions. Through comprehensive flowcharts of user journeys you can trigger innovative thinking while at the same time building strong business cases to support new feature ideas. Innovation doesn’t have to be waved aside as being too costly. Pinpoint opportunities in your market, take advantage of them. Be the first to introduce features in your market without having to bust your brain on how to build them from scratch. Thus, reducing the cost of development.

' actionable data on the best features and user journeys offered around the globe to spark your team brainstorming sessions. Through comprehensive flowcharts of user journeys you can trigger innovative thinking while at the same time building strong business cases to support new feature ideas. Innovation doesn’t have to be waved aside as being too costly. Pinpoint opportunities in your market, take advantage of them. Be the first to introduce features in your market without having to bust your brain on how to build them from scratch. Thus, reducing the cost of development.

Go to business meetings prepared with a fully formulated innovative plan and a solid business case that will get you that longed for green light to proceed. Release these features that truly make customers fall in love with your digital banking offerings.

Book today and discover how to accelerating product development while decreasing costs.

today and discover how to accelerating product development while decreasing costs.