The product development of a digital banking product is more often than not a lengthy and expensive process.

From analyzing the market, conducting competitive analysis, understanding your audience’s needs, formulating a production plan to developing the offering and releasing it takes many iterations of the digital product re-designed which will drive cost upwards and extend go-to-market time.

The result is that a digital product is rolled out with great delay, second to other competitors and your digital banking team has ended up completely exhausted and fatigued by the back and forth in development.

While this is true, Challenger banks however manage to understand their customer needs and release new features within months of that, rolling out new features quickly. Smaller digital banking teams and larger institutions on the other hand take longer years to increase their digital offerings arsenal.

What these digital banking teams need is to streamline their product development process from start to finish. To speed up the process, save on costs if possible and deliver products that will satisfy customers on time.

Using  , the digital banking research platform, teams can accomplish exactly that through 5 steps: they can introduce a new innovative feature into their market in half the time. Let’s examine that through a bank that wants to add a new digital offering: Cryptocurrency investment.

, the digital banking research platform, teams can accomplish exactly that through 5 steps: they can introduce a new innovative feature into their market in half the time. Let’s examine that through a bank that wants to add a new digital offering: Cryptocurrency investment.

1) Have an overview of the market

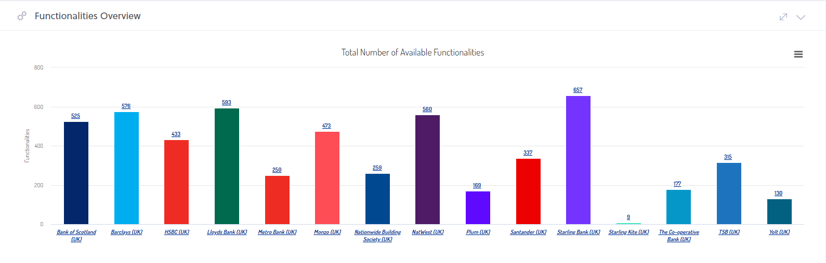

Ranking of the features by UK banks and fintechs

Ranking of the features by UK banks and fintechs

A digital banking team can immediately after signing into the platform have a complete overview of its competitor. In less that 7 clicks they can conduct a thorough competitive analysis, understanding their own strengths and weaknesses as well as their competitors. What are the features that they are missing but their competitors offer and how successfully do they offer it? They have understood that Cryptocurrency investment features really resonate with customers and want to introduce them through their digital banking. Through  they find out that only one other competitor offers that feature in the market.

they find out that only one other competitor offers that feature in the market.

2) Extend your research lens globally

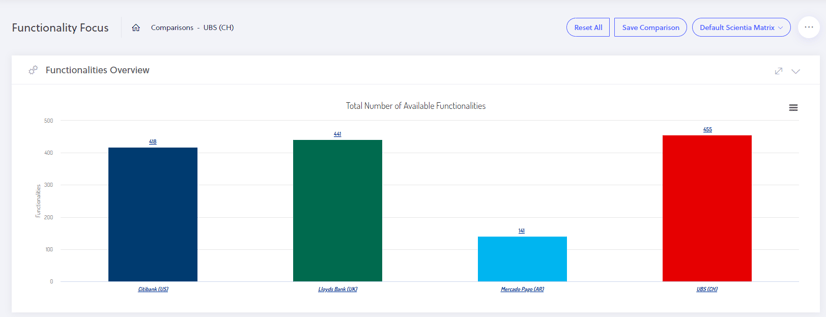

Ranking of the features of various banks internationally

Ranking of the features of various banks internationally

Since they know that only one of their competitors in their local market offers this feature, the digital banking team now has the chance to search the global market for that feature. By expanding its analysis internationally, through the digital banking research platform global pool of analyzed banks, they will discover a few more banks and Challengers that offer Cryptocurrency to their customer base. Then they can discover which one excels and where and how they measure against competitors and internationally.

3) Know which institution does it best and why?

Now that the digital banking team knows which financial institutions provide the Cryptocurrency journey, they can proceed with seeing which offer the most UX friendly journeys. Utilizing  objective analysis on every user journey, they will rank these banks and find that one of them has consistently great UX across all its Cryptocurrency investments features set. They will have an analytical view of how custom personas experience that journey including competitors.

objective analysis on every user journey, they will rank these banks and find that one of them has consistently great UX across all its Cryptocurrency investments features set. They will have an analytical view of how custom personas experience that journey including competitors.

4) Understand how these features are implemented

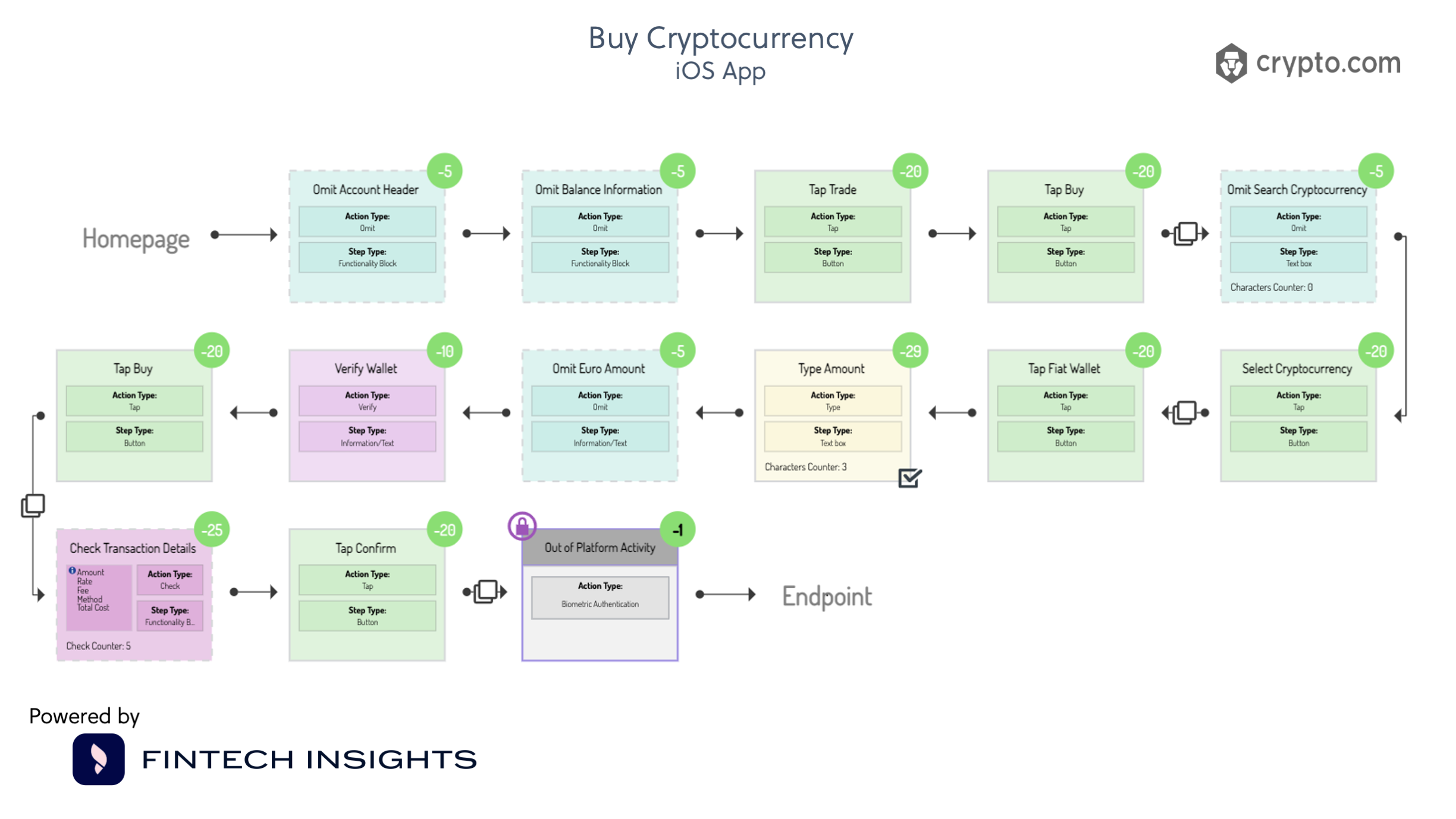

Flowchart of "Buying a Cryptocurrency" in Crypto.com

Flowchart of "Buying a Cryptocurrency" in Crypto.com

Having pinpointed the financial institutions that offer the best UX-evaluated user journeys for the Cryptocurrency features set, the team can drill down into how exactly they offer it. Both through walkthrough videos of the user journeys and analytical step-by-step flow charts, the team will have detailed knowledge on how the competitor has structured and designed their user journey to be efficient and convenient for users. Which are the friction points, which steps of the journey work excellently? How have they tackled regulatory or other obstacles the digital banking team will face when developing that feature set? They will know their competitors weaknesses and learn from their mistakes.

5) Formulate a strategy

With an overview of the direct and indirect competitors in the market and exhaustive information on how they offer the journeys the team can plan its development strategy. Based on actionable data from  they can thoroughly organize their product development factoring what’s actually feasible and the best practices worldwide. They can map out every stage of the new feature set development ensuring efficiency and speedy delivery. Knowing how a feature is implemented will help the team avoid any surprises during the development process and have the analytical specifications for the next user journey production or the following ones and plan their resources accordingly.

they can thoroughly organize their product development factoring what’s actually feasible and the best practices worldwide. They can map out every stage of the new feature set development ensuring efficiency and speedy delivery. Knowing how a feature is implemented will help the team avoid any surprises during the development process and have the analytical specifications for the next user journey production or the following ones and plan their resources accordingly.

This article was originally published on July 27, 2021 and was updated on August 9, 2022.Explore

today and start improving your feature set with accuracy and speed.